Best Buy and GreatCall: Unexpected Partnerships are the New Normal in Healthcare

Best Buy, the electronics retailer, recently announced an $800M deal to buy GreatCall, a health technology company that focuses on the elderly. Read on to learn why the deal makes sense for Best Buy and the surprising trends behind it.

What is GreatCall?

The company provides connected health and emergency response services to more than 900,000 paying subscribers. GreatCall offers mobile products and wearables for seniors who find themselves in trouble – with the touch of a button, users can get connected by an agent to emergency personnel, family members, or general services. GreatCall currently serves about 2 percent of the US population over 65. To quote Best Buy, “It has an award-winning approach to customer care that helps older consumers stay independent longer, provides peace of mind to family caregivers and reduces healthcare costs.”

Why did Best Buy acquire GreatCall?

Simply put, the health and wellness space is a market with high demand and strong growth — especially for baby boomers and the elderly. Best Buy hopes to leverage its reputation with older shoppers to provide not only technology, but also services to meet their needs. Best Buy said the deal is part of its Best Buy 2020 strategy, which aims to help customers use technology to address key human needs.

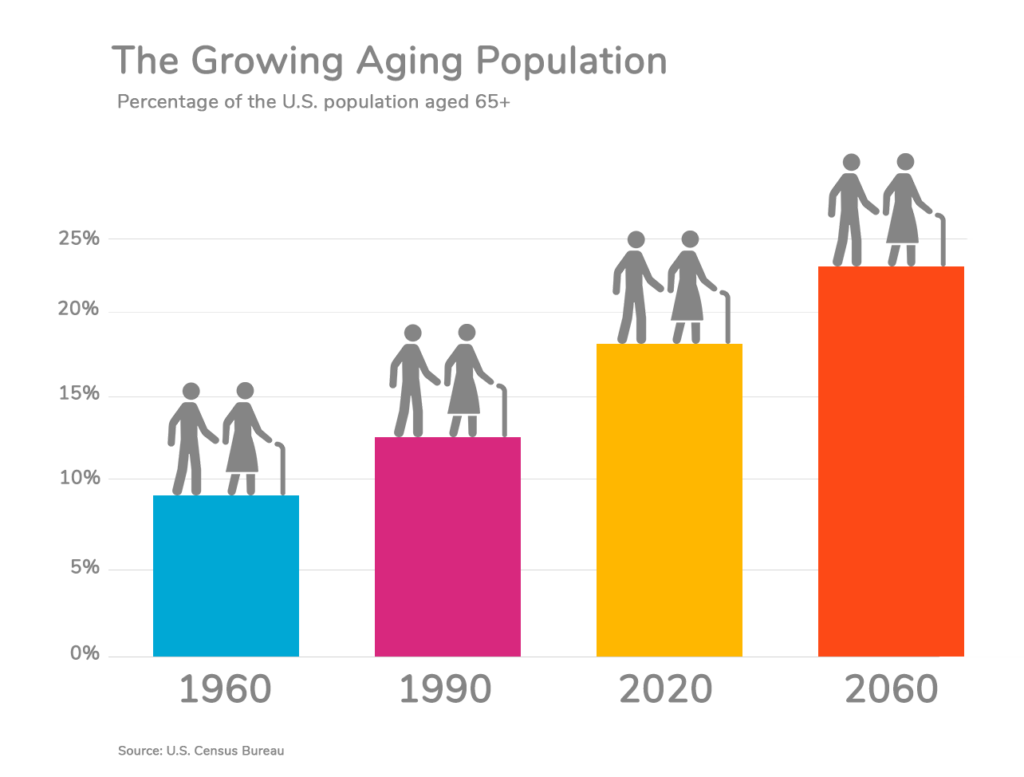

There are about 50 million Americans today who are older than 65. The number is expected to grow by more than 50 percent in the next 20 years amid demographic shifts in the U.S. This group is widely viewed as underserved by the technology giants. Analysts noted that the assured living market is estimated to be worth about $28 billion and is growing at a pace of roughly 20 percent annually.

Why does this news matter?

This news is yet another example of the evolving healthcare landscape and ecosystem, where unexpected partnerships arise on a regular basis. Established organizations are looking to enhance their foothold and relationship strength with target populations, while health and wellness devices are becoming a more common platform for growing and sustaining those relationships – as this deal has shown.

Further Reading

Demographics are changing in the U.S. – and across the world. See this special report from Axios, complete with interactive maps, to understand how, why, and what to expect by 2100.

Next on industry insights.

How to Futureproof Your Healthcare Benefits

Read the Blog

Why Partnering with an AAAHC Accredited Organization is a Win for Your Workforce

Read the Blog